The world’s major economic powers are all suffering from the economic downturn but even the most cynical doomsayer is sure we’ll get ourselves out of this mess—eventually. Rare are those instances in which entire economies are disrupted to the point - typically as a result of rampant inflation, or hyper inflation - that an entire form of currency is discarded, reformed or replaced. But it does happen. There are invariably external issues (military, political, etc) at play, which result in what can generally be referred to the ‘failure of a currency’, and each situation is unique. The following is a list of nine notable examples in which currencies became so devalued that they were eventually replaced:

Germany Weimer Republic 1922-1923

By the end of 1922 Germany found it was no longer able to pay the war reparations set forth by the Treaty of Versailles. French and Belgian armies responded by occupying Germany’s most productive, and industrial regions. German industrialists then ordered workers strikes, which put further pressure on an already frail economy. The German government countered this situation by printing unbacked currency with which it meant to pay both workers benefits, as well as its delinquent international debt. Supply and demand followed: too much money was circulated, and the money was soon considered worthless. In 1922, the largest denomination of the Papiermark was 50,000. A year later it was 100 Trillion. This means that by December 1923, the exchange rate with the US Dollar was 4.2 Trillion to 1. It is estimated that by November 1923, the yearly inflation rate was considered 325,000,000%. This means that the cost of goods were increasing about every two days. As a result, the Rentenmark was introduced at a rate of 1 to 1 Trillion of the Papiermark. Reparation payments eventually continued, and France and Belgium agreed to leave the country.

Hungary 1945-1946

The Great Depression put an initial strain on the Austrian Pengo, originally introduced with great strength as a replacement to the Austrian-Hungarian Korona in 1926, per the Treaty of Versailles. Next, the associated effects of World War II would run their course. In 1944, the Hungarian Pengo’s highest denomination was the 1,000 note. A year later it was 10,000,000. And by mid-1946, it was 100,000,000,000,000,000,000. Realizing that this type of hyperinflation and denomination increase was not sustainable - and after 20 short years - the Pengo was replaced by the Forint. There are famous pictures of this event, which include street sweepers cleaning the sea of Pengo notes that Hungarians so eagerly discarded. At the time of this replacement, the Pengo to Forint exchange, was Four Hundred Octillion (That’s 29 Zeros) to one. That same Forint would exchange for 11.74 to $1USD. Inflation has since continued at a much more subdued rate, and the current exchange is valued at approximately 195.2 Forint to 1 $USD. It is estimated that at the time of replacement, the value of all Hungarian currency in circulation equaled less than one-thousandth of one US dollar!

Chile 1971-1981

Shortly after the ascension to the office of president, Socialist President Salvador Allende, decreed that many of Chile’s leading industries would be nationalized. Owing predominately to management problems (with bureaucrats overseeing the market) this government soon began hemorrhaging money, and in order to subsidize the loss, the Chilean Central Bank began printing unbacked currency at an alarming rate. This resulted in an inflation rate of 600% by the end of 1972; inflation eventually skyrocketed to 1200% by the end of 1973. This was the same year General Augusto Pinochet’s US-backed coup d’état seized control and installed his populist military regime. Shortly thereafter, in 1985, the Escudo (1960-1975) was replaced by the New Peso at a rate of 1,000 to 1. Except for a slight depression in 1981, the Chilean economy recovered, largely due to the government’s decision to sell off newly acquired State-owned enterprises. The rest of PinochetR 17; s tenure in Chile, however, is entirely another story.

Argentina 1975-1992

After unprecedented annual growth rates and record trade surpluses, panic and political unrest broke out between Argentine Trotskyists and the Perón loyalists, in the wake of the 1973 oil crisis. Conflict came to a head in 1975, when a sharp recession looked inevitable. The Argentine government then exacerbated the situation by refusing to borrow in order to cover its budget and trade deficits. In 1975, the largest Argentine Peso denomination was 1,000. A year later the 5,000 note was introduced. In March 1976, a violent coup was staged by the country’s military leaders, who promised to bring stability to the region. By ‘79, there was a 10,000 Peso banknote and by 1981, the Argentine Central Bank had introduced a 1,000,000 Peso note. The country’s economy declined, further worsening the situation - in between 1981 and 1982, Argentina’s GDP fell 12%, the worst single year decline since The Great Depression. When the currency was reformed in 1983, 1 Peso Argentino was exchanged for 10,000 of the “old” Peso. Then in 1985, the ‘Austral’ was introduced, which replaced the Peso Argentino at a rate of 1-to-1,0000 Then yet again, in 1992, the New Peso replaced the Austral this time at 1-to-10,000. This end result of this experience - in many circles referred to as, “The March of Zeros” - equated to a 1 New Peso equal to 100,000,000,000 Pre-’83 Pesos.

Peru 1988-1991

During the 1980s, Peru, like many Latin American countries introduced a number of trade liberalization polices. At the same time, government increased public spending, privatized enterprise, and neglected to service the nation’s external debt. As a result, by the end of the 1990s, Peru’s already small economy - which once had been enticing avenue for foreign direct investment - was experiencing not only negative economic growth, but also deficits of all types, as well as hyperinflation. While hyperinflation became apparent, the Peruvian government replaced the Peru “Old” Sol with the Inti, in 1985, at a rate of 1,000 to 1. The largest denomination of this new currency, was a 1,000 note. In two years, monthly inflation would increase by a rate of 132% in September 1988, and later 400% by September 1990. In order to facilitate the new higher prices of goods and services, new notes were introduced such as the 10,000,000 Inti note by 1991. Again, Peruvi an government decided again to replace the currency, this time with the Neuvo Sol, at a rate of 1,000,000,000 to 1. The result was a currency that was worth one billion times that of only six years before.

Angola 1991 - 1999

Angola’s story is an unfortunate one, and while it is today one of the fastest growing economies in the world, the country was plagued by civil war from 1975 to 2002. This conflict placed a large strain on the nation’s economy, as well as its currency, the Kwanza. In 1991, the largest note was the 50,000 kwanza denomination. By ‘94, there was the 500,000 banknote. In 1995, the Readjusted Kwanza (Kwanza reajustado) was introduced for 1,000 Kwanzas. The new currency also had a 500,000 denomination. When the country changed currencies in again in 1999, the New Kwanza was introduced, exchanging for 1,000,000 of the reajustados; by this time, the new currency was equal to one billion of the pre-’91 Kwanzas.

Yugoslavia 1992-1995

Between 1988 and 1989, the Yugoslavian Dinar’s largest denomination switched from 50,000 to 2,000,000 notes. The New Dinar replaced the Dinar in 1992, at a rate of 1 to 10, with the highest denomination being 50,000. By 1993, this was 10,000,000,000. In answer to this sharp increase inflation, Tito’s government simply removed six zeros, meaning that the “Newer” Dinar replaced the “Old Dinar” at a rate of 1 to 1,000,000. In the next year the currency was replaced yet again, this time at the rate of 1 to 1,000,000,000! By January 1995, prices had increased a quadrillion percent in two years, and as a result the German Mark became the country’s Fiat currency. It is estimated that during the height of hyperinflation (December 1994), inflation was increasing by a rate of 100% per day. In fact many Yugoslavians during this time sought to forgo paying their bills for as long as possible, because it several weeks the amount owed would seem relatively cheap!

Belarus 1994-2002

Shortly after the Cold War, many of the newly independent Eastern Bloc states began to experience the pains of a currency fluctuation, and moving towards a market-based economy. At the time of independence, Belarus was had a relatively highly developed economy, and it’s citizens experienced a standard of living among the highest of eastern Europe. In 1993, the largest Belorussian note denomination in circulation was the 5,000 Rubles. By the end of the decade, this had increased to 5,000,000 notes. In an effort to displace this, the government replaced the new Ruble at an exchange rate of 1 to 1,000 “old” Ruble. Presently, the highest denomination is the 100,000 note, which is equal to 100,000,000 1993 Ruble. Many people credit the high rates of inflation to the leadership of Lukashenko who has been in office since 1994. Today 80% of the country’s industries are still nationalized.

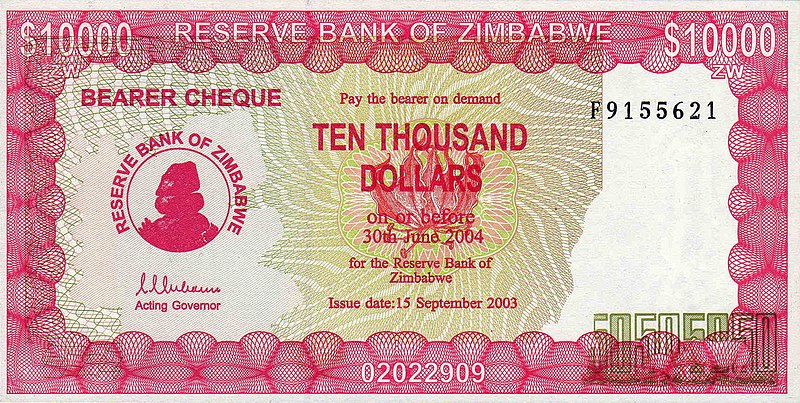

Zimbabwe 2000-2009

When Zimbabwe became an independent African state in 1980, the Zimbabwe dollar was actually valued higher than the US dollar, at a rate of 1 to 1.25. Through a series of questionable race-based land seizures and rampant money-printing, the Zimbabwe dollar began to experience rampant inflation by the early 21st century. By 2004, inflation reached a then-all time high of 624%, before going below triple digits in 2005, and then surged up to to 1,730% in 2006. In August 2006, the currency was replaced with a New Zimbabwe dollar at a rate of 1 to 1,000. By mid-2007, inflation reached a yearly increase of 11,000%. By May 2008, 100 Million and 250 Million New Zimbabwe Dollars (ZWD) denominated notes were released, and less than two weeks later, a 500 Million ZWD note was introduced (valued at about $2.50). Then less than a week later, 5 B, 25 B and 50 B ZWD notes were introduced, and later, in July, a 100 B denomination was introduced. In August 2008, the government removed ten z eros from the currency, and 10 Billion ZWD became equal to 1 New ZWD, with an estimated annual inflation rate of about 500 quintillion (18 zeros) percent, with a monthly rate of 13 billion percent.

Read more about Hyperinflation: The Story of 9 Failed Currencies…

No comments:

Post a Comment